Published January 11, 2026 · Updated January 11, 2026

For years, the global AI conversation has been framed as an inevitable shift: China rising, the United States declining.

But that narrative is quietly being revised — by China’s own AI leaders.

According to public statements from senior Chinese AI executives and researchers, China is not on track to surpass the United States in foundational AI breakthroughs anytime soon, despite massive investment, strong IPO activity, and state support. These assessments align with independent reporting from global financial and technology analysts across the current state of the AI market.

This is not humility.

It is strategic realism.

What China’s AI Leaders Are Really Saying

The message coming from China’s AI sector has become more nuanced.

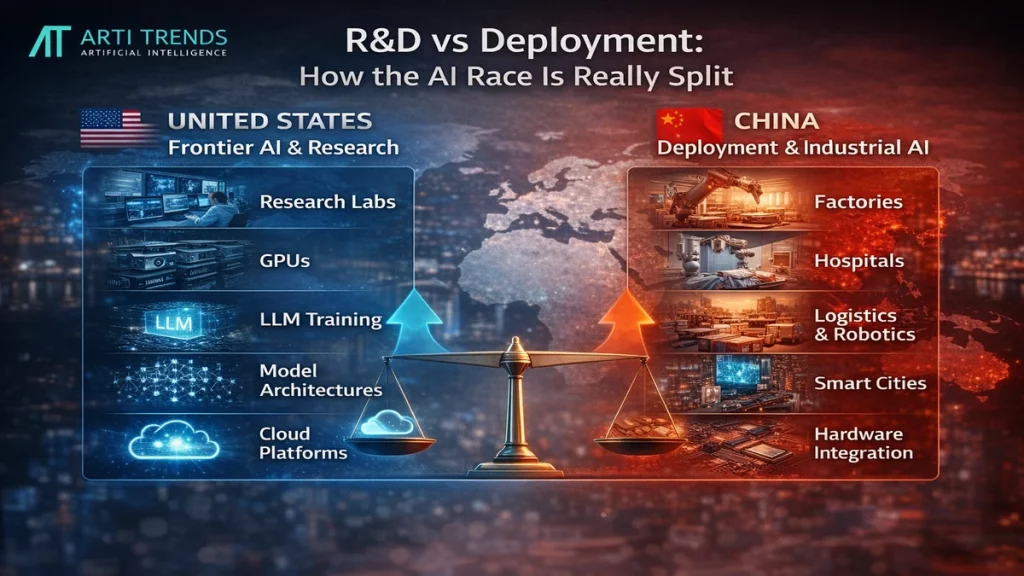

China is:

- strong at deployment

- efficient at scaling

- excellent at commercializing

But the United States still dominates:

- large-scale model architectures

- training techniques

- advanced semiconductor design

- foundational AI research

In other words: the technologies that determine who controls the direction of artificial intelligence itself.

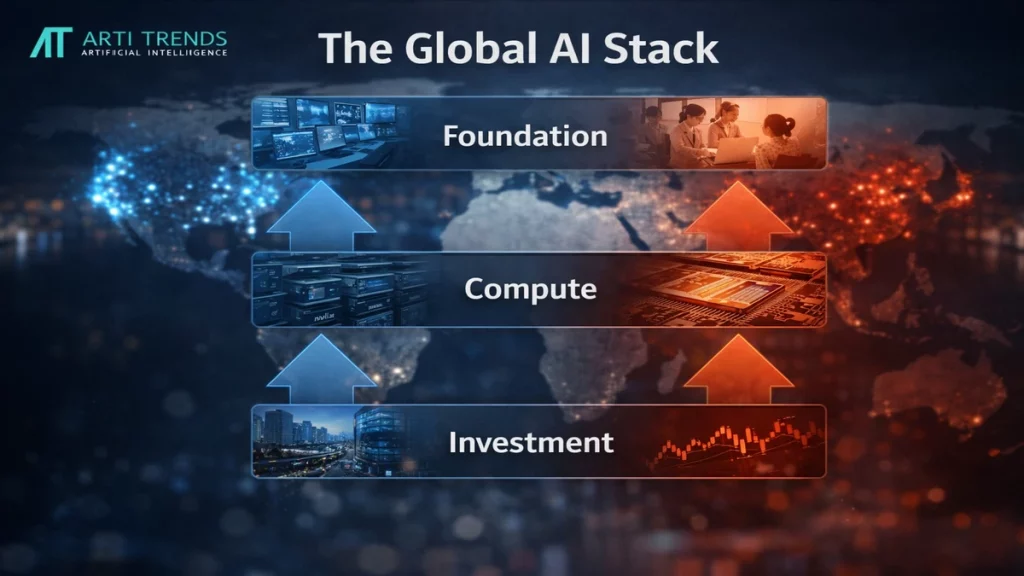

Why the U.S. Still Holds the Advantage

The U.S. does not lead because of one company or policy.

It leads because it controls three critical layers of the AI stack.

Frontier research

Most major advances in multimodal models, reasoning systems, and large-scale training still emerge from U.S.-based labs.

Semiconductor dominance

Companies like Nvidia and AMD give American AI developers preferential access to the world’s most advanced compute.

Capital concentration

The deepest pools of venture capital and private funding continue to back U.S. AI firms at unmatched scale.

Together, this creates a powerful feedback loop: better chips → better models → more investment → better chips.

Why China Is Still a Serious Competitor

China is not losing the AI race.

It is playing a different one.

Rather than focusing on frontier breakthroughs, China is increasingly optimized for:

- industrial deployment

- vertical integration

- cost efficiency

- nationwide implementation

This positions Chinese AI companies to dominate in areas like manufacturing, logistics, healthcare infrastructure, and smart cities — even if the core models come from elsewhere.

What This Means If You Use AI

For companies and developers outside China and the U.S., this matters more than it may seem.

If you rely on AI tools, expect:

- U.S. platforms to remain the source of cutting-edge models

- Chinese systems to lead in embedded, large-scale, hardware-driven AI

This means pricing, performance, and reliability will increasingly depend on which ecosystem your software runs in.

What This Means for Investors

This is not a winner-takes-all race.

It is a layered competition.

U.S. firms are positioned to dominate:

- AI platforms

- cloud-based models

- foundational technologies

Chinese firms are positioned to dominate:

- applied AI

- hardware-software integration

- sector-specific deployments

Understanding the global AI investment landscape now requires tracking both sides of the stack — not just national rivalry.

The Bigger Strategic Signal

China’s own AI leaders are doing something unusual: acknowledging limits.

The U.S. still leads in the technologies that define the future of AI systems.

But China is building something just as powerful — the ability to turn AI into physical, industrial, and national-scale infrastructure.

The global AI race is no longer about who builds the smartest model.

It is about who turns intelligence into power.

Sources

This analysis draws on public statements from Chinese AI executives and reporting by major international financial and technology outlets, with interpretation focused on economic and technological implications rather than political positioning.