Published January 25, 2026 · Updated January 25, 2026

For much of the past decade, artificial intelligence funding followed a simple rule: breakthrough research attracts capital.

Labs that trained larger models, published stronger benchmarks, or attracted elite research talent could raise enormous rounds with limited commercial proof. Technical ambition itself functioned as a proxy for future value.

That era is ending.

In recent funding rounds across Silicon Valley and Europe, investors have begun walking away from technically impressive AI labs that lack a clear path to sustainable revenue. In 2026, AI funding has entered a more disciplined phase. Investors are no longer asking how impressive a model is — they are asking how durable the business behind it can become. This shift reflects the broader economic logic behind AI investing capital now follows sustainable value creation rather than technical promise alone.

From Research-Led Optimism to Economic Reality

The early AI boom rewarded possibility. Large language models, generative systems, and multimodal architectures demonstrated undeniable progress, and funding accelerated accordingly.

Over time, however, several structural pressures emerged:

- Training and inference costs increased

- Performance improvements became incremental rather than exponential

- Open-source models reduced defensible differentiation

- Enterprise buyers demanded outcomes, not demonstrations

The result is a market where innovation alone is no longer enough. Value increasingly accrues not at the moment of invention, but at the point of reliable, repeatable use.

Even leading labs such as OpenAI, Anthropic, and DeepMind now emphasize deployment, partnerships, and revenue narratives alongside technical progress.

What Investors Now Evaluate Differently

The most important change in AI funding is not reduced interest — it is heightened scrutiny.

Where capital once flowed primarily toward technical novelty, investors now apply a more operational lens:

| Then (2021–2023) | Now (2025–2026) |

|---|---|

| Model benchmarks | Product adoption |

| Research papers | Revenue architecture |

| Vision decks | Distribution strategy |

| Talent density | Customer retention |

| Scaling compute | Scaling margins |

This reflects a broader shift in how investors now assess AI startups: models are increasingly viewed as infrastructure components, while value concentrates in integration, ownership of workflows, and defensible distribution.

The New Question: Where Does Pricing Power Live?

As competition intensifies, pricing pressure has become a defining concern.

Many AI labs struggle to answer a fundamental question:

Why will customers keep paying as alternatives improve and costs decline?

Pricing power tends to survive only when AI systems are:

- Embedded into core business workflows

- Costly to replace due to retraining or data dependency

- Directly tied to measurable operational outcomes

Labs offering interchangeable capabilities face rapid commoditization. Labs that own decision-critical processes retain leverage.

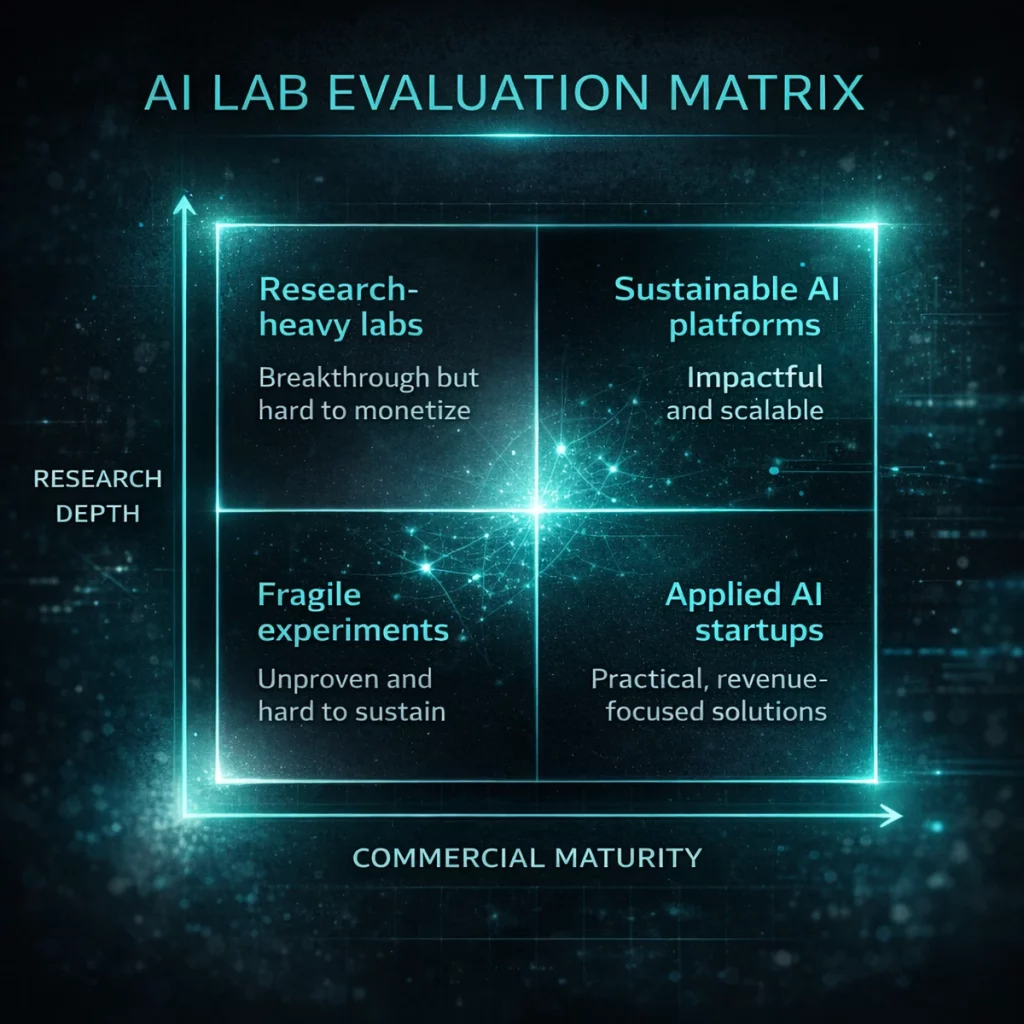

Which AI Labs Are Most at Risk?

This funding transition does not affect all labs equally.

The most vulnerable profiles tend to share common traits:

- Research-first organizations without a defined customer

- Heavy reliance on continuous fundraising to sustain compute

- Differentiation based primarily on benchmarks already matched elsewhere

- Limited sales, distribution, or enterprise integration capacity

These challenges reflect the structural risks shaping AI investment outcomes, rather than failures of innovation itself. In many cases, the technology works — the business does not.

What This Means for Founders

For founders, the implication is straightforward: commercial alignment is now a survival requirement.

This does not mean abandoning research depth. It means synchronizing research roadmaps with value creation:

- Product milestones alongside model milestones

- Revenue signals alongside technical validation

- Market feedback embedded early in development

Founders who can articulate how research translates into sustained customer value continue to attract capital. Those who cannot face narrowing options.

What This Means for Researchers

For researchers, the environment is shifting as well.

Standalone research labs are becoming rarer. Increasingly, research is conducted inside product-driven organizations, where constraints sharpen focus and feedback loops shorten. This often results in:

- Faster iteration cycles

- Clearer impact measurement

- Stronger alignment between innovation and deployment

Fundamental research is not disappearing — it is relocating to institutions, platforms, and funding structures designed for long-term horizons.

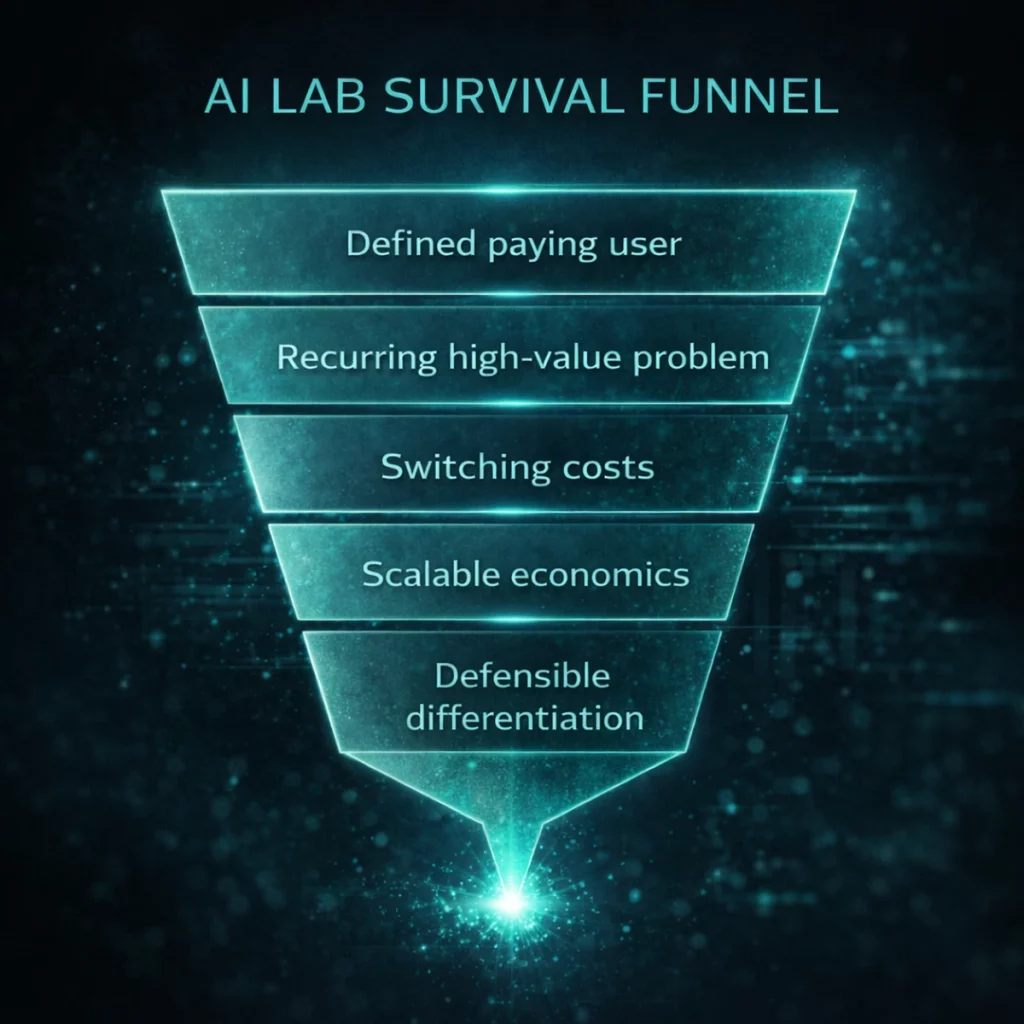

The AI Lab Survival Test

A simple framework helps clarify whether an AI lab is structurally viable:

- Is there a clearly defined user with purchasing authority?

- Does the system solve a recurring, high-value problem?

- Are switching costs present after deployment?

- Can revenue scale without proportional compute growth?

- Is differentiation defensible beyond raw model performance?

Labs that meet most of these criteria tend to sustain momentum. Those that do not often rely on temporary funding cycles rather than durable economics.

A More Disciplined Phase of AI Innovation

The commercialization test confronting AI labs does not signal the end of innovation. It marks a maturation of the ecosystem.

As AI becomes a foundational layer of modern economies, enduring systems will be those that combine technical excellence with economic discipline. Innovation continues — but it is increasingly accountable to outcomes, integration, and sustainability.

Understanding this shift is essential for founders, investors, and organizations navigating the next phase of artificial intelligence.

At Arti-Trends, we analyze these transitions to bring clarity, not hype — helping readers understand how AI value is created, sustained, and scaled in the real world.

Sources & Further Reading

This analysis is based on a synthesis of recent investment commentary, funding trends, and public disclosures from leading AI research organizations and venture capital firms, including:

- OpenAI — public statements and product commercialization strategy

- Anthropic — funding announcements and enterprise deployment focus

- DeepMind — transition from research-first lab to integrated product organization

- Venture capital insights from firms such as Sequoia Capital, Andreessen Horowitz, and Accel on AI commercialization and sustainable business models

- Market analysis and reporting from Financial Times, The Economist, and Bloomberg on AI funding dynamics and valuation discipline

Rather than relying on a single dataset or announcement, this article reflects cross-source pattern analysis — focusing on structural signals in AI funding, commercialization requirements, and long-term sustainability.