Published November 6, 2025 · Updated November 6, 2025

Intro: The Startup Gold Rush in AI

In every technological revolution, there are two kinds of investors — those who buy into the hype and those who spot the signal before everyone else.

Artificial intelligence is the gold rush of our generation, and AI startups are the ones digging for gold.

From medical diagnostics and climate analytics to autonomous drones and generative design, early-stage AI companies are redefining what’s possible. Venture capital firms are pouring billions into these niche players, hoping to find the next Nvidia, OpenAI, or Anthropic before they dominate the market.

But as with any high-potential opportunity, AI startup investing comes with both extraordinary upside and extreme risk. This guide breaks down how early-stage AI investing works, what to look for in a startup, and how retail investors can gain exposure to this explosive sector.

(Want the full overview first? Read our cornerstone guide What Is AI Investing for the fundamentals.)

1. Why AI Startups Matter

Startups are where real innovation happens. While big tech companies refine existing products, AI startups build entirely new categories.

- Hippocratic AI is using large language models to power safe and ethical healthcare communication.

- Runway is reinventing filmmaking with generative AI video tools.

- Skydio creates autonomous drones that can navigate complex environments without GPS.

These companies thrive because they specialize. They focus on solving narrow, technical challenges that larger players often overlook — and that specialization gives them an early edge.

AI startups operate like neurons in a vast global network of innovation. Each one contributes a small but vital signal to the collective evolution of artificial intelligence.

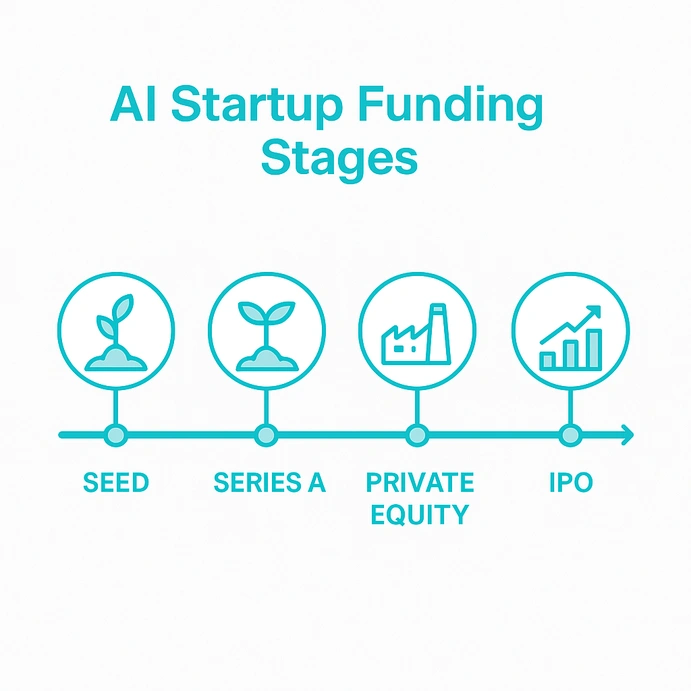

2. The Investment Landscape: Startups vs. Private Equity

Before diving in, it’s essential to understand where AI startup investing fits in the capital landscape.

- Seed & Pre-Seed: Founders raise small rounds to validate their concept. High risk, low liquidity, but potentially massive returns.

- Series A–C: Startups begin scaling, often with venture capital firms leading the way.

- Private Equity (PE): Once a company matures, PE firms may buy stakes to professionalize operations, optimize growth, or prepare for IPO.

For most retail investors, these early stages are off-limits. Venture capital funds and private equity deals typically require accreditation and high minimum investments.

However, new access models are emerging — AI-focused ETFs, crowdfunding platforms, and public venture arms that let individuals invest indirectly in early AI innovation. Top firms like Andreessen Horowitz’s AI Fund are actively backing these next-gen players, shaping the future landscape.

3. The Rewards: Early Entry, Exponential Potential

Why chase AI startups when you could just buy tech stocks?

Because early-stage investing is where exponential returns live.

If you had invested $10,000 in Nvidia in 2001 — back when GPUs were “just for gaming” — that stake would be worth over $4 million today. The same asymmetric potential exists in AI startups developing breakthrough algorithms, data architectures, or robotics platforms.

The math is simple but powerful: one winner can offset dozens of failures. That’s why venture investors are comfortable backing ten companies knowing that nine will fail — the one success can multiply 100x.

The growth trajectory of AI startups is uniquely steep. Once an algorithm works, it scales digitally at near-zero cost. That’s the beauty of IP-driven businesses: marginal costs drop, margins rise, and network effects accelerate adoption.

(If you prefer investing in established AI leaders, check out our guide on AI Stocks to balance your portfolio.)

4. The Risks: Failure Is the Norm

For every OpenAI, there are hundreds of startups that vanish quietly.

AI startup investing is not for the faint-hearted.

Here’s why:

- High failure rate: More than 80% of tech startups fail within five years.

- Illiquidity: You can’t sell shares easily — your money is locked in until acquisition or IPO.

- Hype cycles: Many AI startups chase trends rather than sustainable models.

- Regulatory uncertainty: Data privacy, model transparency, and AI ethics rules can shift rapidly.

The key is disciplined due diligence. Look beyond buzzwords like “LLM” or “AI-powered” and dig into:

- Team – Are the founders both visionary and technically grounded?

- Tech – Is the solution proprietary or easily replicated?

- Traction – Do they have real customers or just a proof of concept?

- TAM (Total Addressable Market) – How big could this get if it works?

In startup investing, survival is the first milestone. Scale comes second.

5. How to Spot Promising Ventures

The difference between a good idea and a great investment lies in pattern recognition.

Here’s what experienced investors look for when scouting early-stage AI startups:

1. A Technical Edge

Does the startup possess a unique algorithm, dataset, or AI architecture?

Startups like Mistral AI and Hugging Face gained traction by publishing open-source models that built massive communities — a moat few can replicate.

2. Real-World Traction

Look for proof points: pilot programs, paying customers, or partnerships with research institutions.

Momentum matters more than marketing.

3. A Scalable Market

Is the startup solving a niche problem that can expand into a global market?

Example: A company building AI tools for medical image analysis could later expand into pharmaceuticals or diagnostics.

4. Strong Founders

Founders are the engine. Seek teams that combine deep technical expertise with commercial instinct — the rare blend that turns prototypes into products.

5. Sustainable Capital Strategy

AI is expensive — training models, renting GPUs, and hiring talent cost millions.

Startups that manage capital wisely are more likely to survive the “AI winter” if hype cools off.

Need data to research startups? Use Crunchbase to analyze founders, funding rounds, and investor profiles.

6. Accessing the Market as a Retail Investor

Even if you can’t invest directly in a private AI startup, there are ways to gain exposure.

1. Crowdfunding & Angel Platforms

Sites like Seedrs and OurCrowd occasionally list vetted AI startups open to smaller investors. Returns are long-term and uncertain, but access is democratizing fast.

2. AI-Focused Venture ETFs

ETFs such as Global X Artificial Intelligence & Technology ETF (AIQ) or ROBO Global Robotics & Automation ETF invest in public companies leading AI innovation. These provide indirect exposure to the startup ecosystem.

3. Listed Private Equity Firms

Some publicly traded PE firms and holding companies invest in AI startups. Examples include SoftBank, Blackstone, or Prosus — though these tend to spread exposure across multiple sectors.

4. Hybrid Models

New platforms blend VC and retail models, allowing smaller investors to co-invest alongside institutions.

This “fractional venture capital” approach could open AI startup investing to a much wider audience in the years ahead.

Want to structure your portfolio around these options?

Check out our follow-up guide on Building an AI Investment Portfolio.

7. Strategic Tips for AI Startup Investors

- Follow the talent, not the trends.

Track where top AI researchers are leaving to build startups. Their exits often signal new frontiers. - Read research papers, not just press releases.

Breakthrough ideas often appear in arXiv or NeurIPS papers before they reach TechCrunch. - Diversify across verticals.

Don’t bet everything on generative AI — explore robotics, biotech AI, and AI infrastructure. - Watch hardware enablers.

Companies developing AI chips, edge devices, or data pipelines often become critical bottlenecks — and profit centers. - Stay patient.

AI innovation compounds slowly, then suddenly. The biggest returns often come from holding early conviction when everyone else doubts.

(For more insights into how artificial intelligence is transforming markets, explore our article on AI in Finance.)

8. The Future: Private AI Markets Go Public

The line between private and public AI markets is blurring.

New tokenized investment platforms and AI-linked securities are emerging, making early-stage exposure more accessible than ever before.

In the next decade, we’ll likely see AI startup shares trading digitally, fractional ownership of models, and hybrid funding models powered by blockchain.

That means the window between “early-stage” and “mainstream” will shorten — and investors who understand the signals will have a massive advantage.

Conclusion: Finding the Next Nvidia

“The next Nvidia is already being built — somewhere in a garage, lab, or open-source repo. The only question is: will you recognize it before everyone else does?”

Investing in AI startups isn’t about gambling on hype. It’s about identifying the builders who are solving real problems with scalable technology — the teams that quietly change how the world works.

If you want to stay ahead of the curve, follow the data, study the people, and think long-term. Because the future of AI investing isn’t just in the giants of today — it’s being coded right now by the startups of tomorrow.

Join the AI Investor Brief

Get exclusive insights, startup analyses, and AI investing updates delivered straight to your inbox.

👉 Subscribe to the AI Investor Brief — and never miss the next big thing.

Or start learning with our AI Academy — designed for future-focused investors and creators.