Published October 2, 2025 · Updated October 29, 2025

AI stocks in 2025 are one of the most exciting—and risky—investment themes of the decade. From Nvidia and Microsoft to emerging challengers, this guide explores the opportunities and risks you need to know before investing in artificial intelligence stocks.

Introduction

AI stocks are dominating financial markets in 2025. What once seemed like a futuristic gamble has become the backbone of global growth, with artificial intelligence reshaping industries from finance and healthcare to energy and entertainment.

Market leaders such as Nvidia, whose chips power nearly every large language model, and Microsoft, integrating OpenAI’s breakthroughs into Azure and Office, highlight how central AI has become to the business strategies of the world’s largest corporations.

The numbers explain the hype: analysts forecast the global AI market will grow from $200 billion in 2024 to more than $1.8 trillion by 2030. For many, it feels like the dot-com boom all over again—a chance to build generational wealth, but also a market filled with inflated valuations and inevitable corrections.

👉 This article explores the opportunities and risks of AI stocks in 2025: who the key players are, why these equities are so attractive, and what investors must watch out for to avoid costly mistakes.

For a complete overview of the different ways to invest in AI, check our cornerstone guide: What is AI Investing? The Ultimate Guide (2025).

Recent Developments in AI Stocks (2025)

The year 2025 has already been pivotal for AI stocks. Market leaders reached new milestones, capital inflows accelerated, and regulators signaled stronger oversight. For investors wondering whether to invest in AI stocks in 2025, the latest headlines offer both optimism and caution.

- Nvidia hit record highs as demand for its GPUs continues to outpace supply, cementing its status as one of the best AI stocks 2025. Yet some analysts warn valuations are running ahead of earnings.

- Microsoft expanded its AI ecosystem, embedding OpenAI’s tools across Azure and Office. Its scale makes it a relatively stable AI investing stock, though heavy spending raises short-term profitability questions.

- Palantir positioned itself as a mid-cap AI play, winning enterprise and government contracts. Supporters call it a rising star; critics see hype exceeding fundamentals.

- Challengers like C3.ai, UiPath, and healthcare startups gained attention from retail investors chasing “the next Nvidia,” but their performance remains volatile.

Institutional investors have significantly increased exposure, while financial media warn of dot-com-like overvaluation. The consensus: AI stocks in 2025 are both a massive opportunity and a potential bubble.

👉 Takeaway: investors should stay engaged, but avoid blindly following hype-driven rallies.

Why AI Stocks Are Attractive in 2025

For many investors, AI stocks in 2025 are one of the decade’s most compelling opportunities. The combination of rapid market growth, widespread adoption, and strong institutional momentum sets the stage for long-term potential.

Explosive growth potential

Analysts expect the global AI market to surge from $200 billion in 2024 to $1.8 trillion by 2030. Few sectors match this trajectory, making AI equities among the best AI stocks to watch in 2025.

Adoption across industries

AI is powering breakthroughs in:

- Healthcare: drug discovery and diagnostics.

- Finance: fraud detection and algorithmic trading.

- Automotive: self-driving systems and AI-driven manufacturing.

- Retail & Media: recommendation engines and generative content.

This cross-industry adoption means AI investing stocks extend far beyond Big Tech. Want broader exposure with less risk? Consider ETFs instead of single stocks. 👉 Read more: Best AI ETFs to Invest in 2025.

Institutional backing

Pension funds, sovereign wealth funds, and asset managers are ramping up exposure to AI. When Wall Street and Silicon Valley align, history suggests it’s more than hype.

Generational opportunity

Just as the internet created Amazon and Google, today’s AI leaders may become tomorrow’s trillion-dollar giants. Early exposure to AI stocks in 2025 could prove transformative for long-term portfolios.

Infrastructure vs. Applied AI

Not all AI stocks in 2025 are created equal. Investors can think in two categories:

- AI Infrastructure Stocks: companies like Nvidia and AMD that build the chips and cloud platforms powering artificial intelligence.

- Applied AI Stocks: firms using AI to disrupt industries such as healthcare (drug discovery), finance (algorithmic trading), or mobility (autonomous driving).

This distinction matters: infrastructure plays tend to be safer long-term bets, while applied AI can deliver higher—but riskier—returns.

👉 Bottom line: AI stocks offer rare scale and innovation, but picking winners requires a sharp focus on fundamentals.

Want broader exposure with less risk? Consider ETFs instead of single stocks. 👉 Read more in our guide: Best AI ETFs to Invest in 2025.

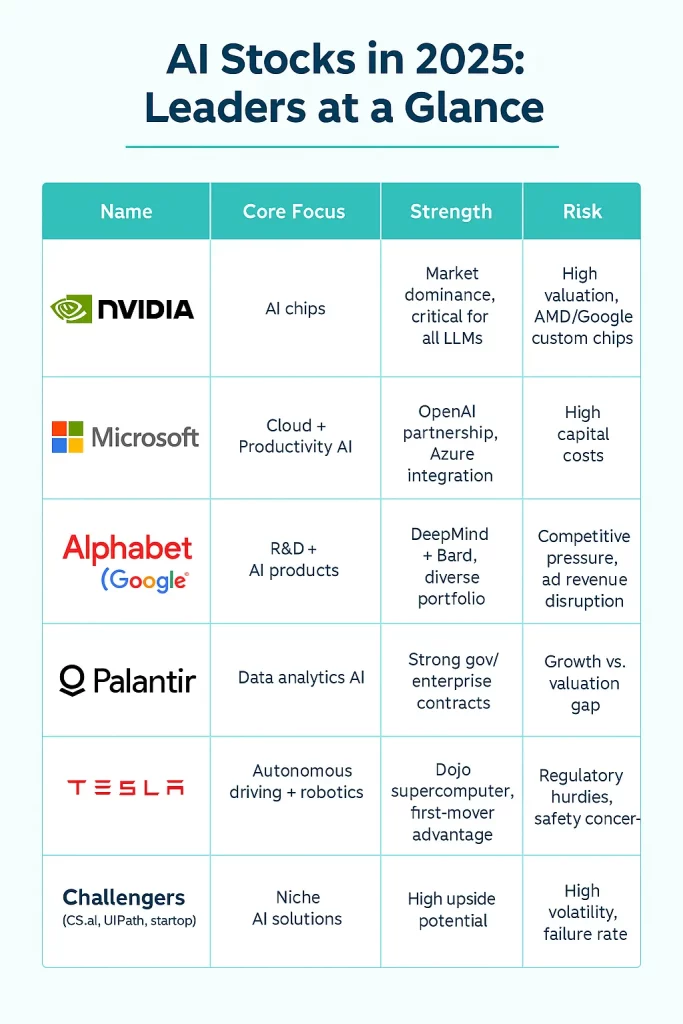

The Biggest Players to Watch

When it comes to AI stocks in 2025, a few companies dominate the field. These firms provide the infrastructure, platforms, and applications driving global AI adoption.

Nvidia – The Infrastructure King

Nvidia’s GPUs are the backbone of nearly every major AI model.

- Upside: explosive demand for AI chips.

- Risk: stretched valuation and rising competition from AMD and custom chips.

Microsoft – The Platform Integrator

Through its OpenAI partnership, Microsoft has embedded AI into Azure, Office, and GitHub Copilot.

- Upside: wide distribution and enterprise adoption.

- Risk: high AI spending may limit near-term profits.

Alphabet (Google) – The R&D Powerhouse

Google Cloud AI, Bard, and DeepMind keep Alphabet central to AI innovation.

- Upside: diverse portfolio and unmatched research.

- Risk: advertising disruption and fierce competition.

Palantir – The Data Analytics Challenger

Palantir’s AI Platform (AIP) is gaining traction in government and enterprise contracts.

- Upside: unique AI-first positioning.

- Risk: growth may lag investor expectations.

Tesla – The Robotics & Mobility Play

Tesla is as much an AI company as an EV firm, with its Dojo supercomputer and autonomous driving systems.

- Upside: first-mover in self-driving.

- Risk: safety and regulatory hurdles.

Emerging Challengers

Smaller names like C3.ai, UiPath, and healthcare AI startups offer speculative upside but face volatility and survival risk.

👉 Together, these players form the core of AI investing stocks in 2025—from trillion-dollar giants to ambitious newcomers.

The Biggest Risks of AI Stocks

For all the excitement around AI stocks in 2025, investors must recognize that opportunities come with real risks. Much like the dot-com boom, some companies will thrive—others will collapse.

Overvaluation and Hype

AI valuations have soared faster than earnings, with leaders like Nvidia trading at bubble-like levels. A slowdown could trigger sharp corrections.

Regulatory Uncertainty

The EU AI Act and U.S. policy debates may reshape business models overnight. Investors must watch regulation closely, especially in healthcare, finance, and autonomous driving.

Technological Disruption

AI evolves at breakneck speed. Today’s leading model—or company—can be overtaken within years, making concentrated bets risky.

Competition from Big Tech

Microsoft, Alphabet, and Amazon dominate the landscape, squeezing smaller players like C3.ai. Mid-cap AI investing stocks may struggle to survive.

Volatility in Emerging Players

AI-focused startups and smaller-cap equities can deliver massive returns—but they can also collapse quickly. Retail investors chasing the “best AI stocks 2025” often find themselves exposed to extreme volatility and sudden losses. Volatility isn’t limited to equities—AI-linked tokens can be even riskier. 👉 Explore them here: Top AI Cryptocurrencies in 2025.

Ethical and Social Backlash

Bias, job losses, or scandals could hit valuations hard. Public trust and compliance will shape long-term winners.

Geopolitical Risks

Another factor shaping AI investing stocks in 2025 is geopolitics. U.S. restrictions on advanced chip exports to China, and China’s push for self-sufficiency, create uncertainty for companies like Nvidia, AMD, and even Microsoft’s cloud operations. Trade wars and sanctions could disrupt supply chains, impacting earnings and stock performance.

👉 Takeaway: The risks of AI stocks are real, from hype-driven overvaluation to regulatory and ethical hurdles. Smart investors diversify and avoid chasing headlines.

Practical Implications for Investors

The rise of AI stocks in 2025 brings both opportunity and volatility. To benefit, investors need a disciplined approach.

1. Balance Growth and Risk

Allocate only a portion of your portfolio (5–15%) to AI investing stocks, depending on risk tolerance.

2. Diversify Exposure

Mix leaders like Nvidia and Microsoft with mid-caps (Palantir, UiPath) and smaller innovators. A basket approach reduces single-stock risk.

3. Use AI ETFs

For beginners, AI ETFs offer broader exposure and reduced risk compared to picking individual winners.

4. Focus on Fundamentals

The best AI stocks 2025 will show strong earnings, adoption, and defensible advantages—not just media buzz.

5. Track Regulation

AI laws like the EU AI Act can reshape profitability. Stay updated, especially in sensitive sectors.

6. Stay Flexible and adaptive

AI is moving faster than most industries. The winners of today could be challenged tomorrow by new breakthroughs. Successful investors monitor quarterly earnings, product launches, and competitor moves—then adjust their strategies accordingly.

Not sure where to start? Our full guide explains step by step: What is AI Investing? The Ultimate Guide (2025).

7. Follow Earnings and Roadmaps

AI leaders publish quarterly results and product roadmaps that often move stock prices. Nvidia’s earnings calls, Microsoft’s Azure AI updates, and Alphabet’s product launches provide vital signals for investors. Staying close to these updates helps answer the key question: “Should I invest in AI stocks in 2025?”

👉 Bottom line: Success with AI stocks in 2025 means diversifying, staying informed, and investing with vision—not hype.

Conclusion: Balancing Opportunity and Risk

AI stocks in 2025 stand at the intersection of extraordinary innovation and serious uncertainty. Companies like Nvidia, Microsoft, and Alphabet are fueling one of the fastest-growing markets of the decade, while challengers like Palantir, Tesla, and smaller startups offer speculative upside. For investors, this creates a landscape rich with possibility—but also one that demands caution.

The opportunities are real: analysts project AI-related markets will approach $1.8 trillion by 2030, making artificial intelligence one of the most powerful investment themes of our time. At the same time, risks such as overvaluation, regulation, volatility, and rapid technological change mean that not every stock will be a winner.

The key is balance. Investors who approach AI stocks with diversification, patience, and a focus on fundamentals are more likely to benefit than those chasing hype. Think of AI not as a quick trade, but as a long-term structural shift—similar to the internet in the 1990s or smartphones in the 2000s.

👉 Bottom line: AI stocks in 2025 are a once-in-a-generation opportunity, but they require discipline. Invest with vision, not FOMO.

AI stocks are only one part of the bigger picture. Dive deeper in our comprehensive guide: What is AI Investing? The Ultimate Guide (2025).

FAQ – AI Stocks in 2025

Should I invest in AI stocks in 2025?

AI stocks are a strong long-term opportunity, but also volatile. Beginners may start with AI ETFs for broad exposure, while advanced investors can mix leaders like Nvidia and Microsoft with smaller challengers. Always match your risk tolerance.

What are the best AI stocks to watch in 2025?

Top AI stocks include Nvidia (chips), Microsoft (platform integration), Alphabet (R&D), Palantir (data analytics), and Tesla (autonomous driving). Smaller players like C3.ai and UiPath also attract attention, though with higher risk.

What are the main risks of AI investing stocks?

Key risks include overvaluation, regulatory changes, rapid technological disruption, and heavy competition from Big Tech. Emerging startups and AI-linked tokens are especially volatile.

How do I start investing in AI stocks?

Define your goals, start small, diversify across leaders and sectors, and keep informed about regulation and earnings. Beginners often use AI ETFs to get exposure with less risk.

Pingback: What is AI Investing? | Ultimate Guide 2025 by Arti-Trends

Pingback: Best AI ETFs to Invest in 2026 - Arti-Trends

Pingback: How to Invest in AI Startups (and Spot the Next Nvidia)