Published November 7, 2025 · Updated November 20, 2025

1. What Makes AbCellera AI Stock Worth Watching

When people search for AI stocks, they often look at chipmakers or big software companies. Yet few realize that one of the most promising AI stocks is hidden in biotechnology.

AbCellera AI stock (NASDAQ: ABCL) represents a new kind of AI company — one that applies deep learning and automation to revolutionize how drugs are discovered. It doesn’t just use AI to write code or generate text; it uses AI to analyze biological data and design new antibodies that can fight real diseases.

2. How AbCellera Uses AI in Biotech

AbCellera’s AI platform screens millions of immune cells using microfluidic chips and advanced machine learning.

Here’s how the AbCellera AI stock ecosystem works:

- Microfluidics: Tiny chips test millions of antibody-producing cells simultaneously.

- Machine Learning Models: Predict which antibody sequences are the most effective against disease targets.

- Automation: Robotics and data pipelines continuously improve accuracy and speed.

The result? Drug discovery that used to take years can now happen in weeks, giving AbCellera AI stock a competitive advantage over traditional biotech firms.

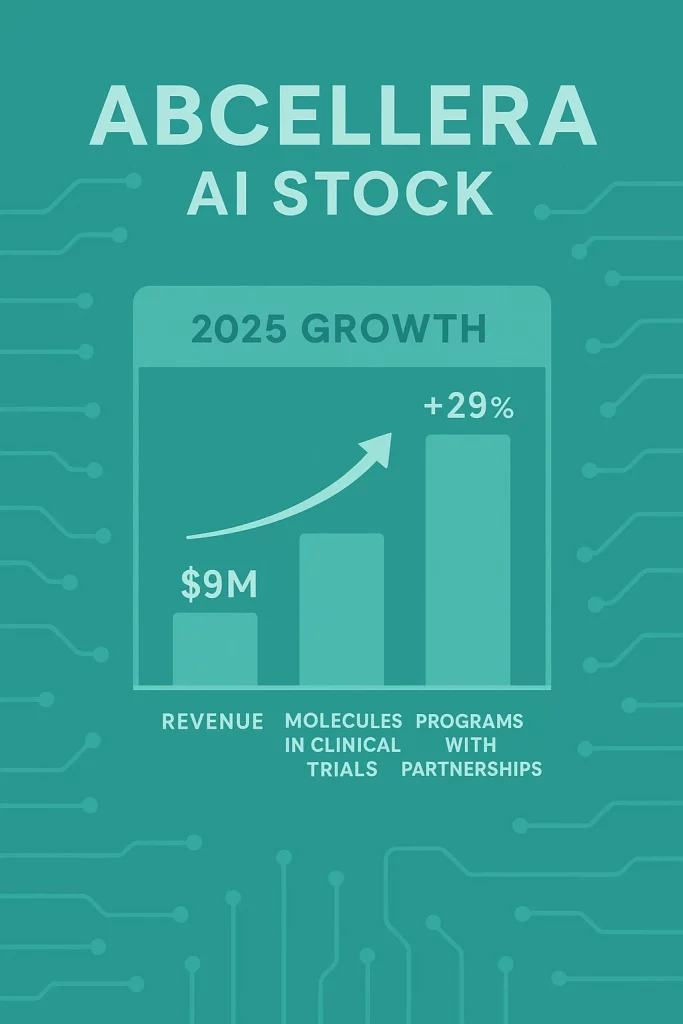

3. AbCellera’s Q3 2025 Results: Progress Behind the Numbers

The company’s latest earnings report (Q3 2025) shows measurable growth despite ongoing R&D expenses:

| Metric | Q3 2025 | Q3 2024 | Change |

|---|---|---|---|

| Revenue | US$ 9.0 million | US$ 6.5 million | +38 % |

| Net Loss | US$ 57.1 million | US$ 51.1 million | +12 % |

| Programs with downstream rights | 103 | 95 | +8 % |

| Molecules in clinical trials | 18 | 14 | +29 % |

| Cash & Investments | ~US$ 680 million | ~US$ 670 million | Solid |

(Source: AbCellera Investors Q3 2025)

With nearly US$ 700 million in cash, AbCellera can fund R&D for several years without new dilution — a strong sign for long-term investors tracking AbCellera AI stock.

4. Why AbCellera AI Stock Is Different

🧠 AI as a Scientist

Unlike most tech-focused AI stocks, AbCellera AI stock uses artificial intelligence to process biological data — finding antibodies invisible to human intuition.

⚙️ Automation as Leverage

By merging robotics and data science, AbCellera’s automated labs generate continuous feedback loops that strengthen the AI engine behind every discovery.

🔬 From Partner to Product Maker

After working with Eli Lilly on COVID-19 antibodies, AbCellera is now advancing its own clinical pipeline, moving from technology provider to full-fledged biotech innovator.

5. Financial Reality: Long-Term Investment, Not Short-Term Hype

AbCellera AI stock is still in its growth phase — not yet profitable, but building enormous long-term value.

- R&D spend: ~US$ 41 million in Q3 2025

- Government grants: ~US$ 200 million non-dilutive funding

- Runway: ~4–5 years of operations fully financed

In biotech, negative earnings aren’t red flags — they’re signs of reinvestment. AbCellera’s expanding clinical portfolio (18 molecules) shows real pipeline depth behind the ticker ABCL.

6. The Bigger Picture: AI Meets Biotech

The rise of AI biotech stocks signals the next major wave in artificial intelligence.

While generative AI dominated headlines, biological AI may shape the next decade of innovation.

Reports by McKinsey (2025) estimate that AI could reduce pre-clinical drug development costs by up to US$ 300 million per drug. AbCellera’s work proves that — through AI — data becomes a new form of medicine.

7. What Investors Should Know

Bull Case for AbCellera AI Stock

- AI platform validated by major pharma partners

- Expanding internal pipeline (+29 % YoY)

- Strong cash reserves and non-dilutive funding

- Potential long-term royalties on successful drugs

Bear Case

- No near-term profitability

- Regulatory and trial risk

- Market impatience with early-stage biotech

For patient investors, AbCellera AI stock could be a deep-tech compounder — similar to how NVIDIA was in 2013: misunderstood, but positioned for exponential growth.

8. Lessons for AI Entrepreneurs

AbCellera’s journey offers key insights for founders and innovators:

- Build AI that solves real-world problems.

- Own your data pipeline — it’s your moat.

- Think long-term: invest in infrastructure before monetization.

These lessons apply not only to biotech but to every AI-first company aiming for sustainable impact.

9. Final Thoughts

AbCellera AI stock isn’t just a ticker symbol — it’s a case study in how artificial intelligence is transforming science itself.

The company’s blend of deep learning, automation, and biology could redefine how medicines are discovered in the coming decade.

For investors seeking exposure to AI with real-world outcomes, AbCellera AI stock (ABCL) may be one of the most promising opportunities to watch in 2026 and beyond.