Published January 10, 2026 · Updated January 10, 2026

The scale of today’s AI race is no longer measured in breakthroughs — it is measured in capital.

xAI has announced a $20 billion Series E funding round, one of the largest private investments ever made in artificial intelligence. The funding itself is factual.

The strategic implications are not.

What this round really signals is that the industry has entered AI’s Infrastructure Dominance Phase — a period in which compute, data pipelines, and operational scale matter more than raw model novelty across the current state of the AI market.

Key Takeaways

- xAI’s $20B raise confirms that frontier AI is now a capital-intensive industry

- Infrastructure ownership is becoming a competitive moat

- Safety, reliability, and compliance are rising in importance

- The funding arms race raises the barrier for smaller players

- AI is shifting from experimentation to industrial deployment

Why $20B Matters More Than It Looks

In AI, money is not just fuel — it is leverage.

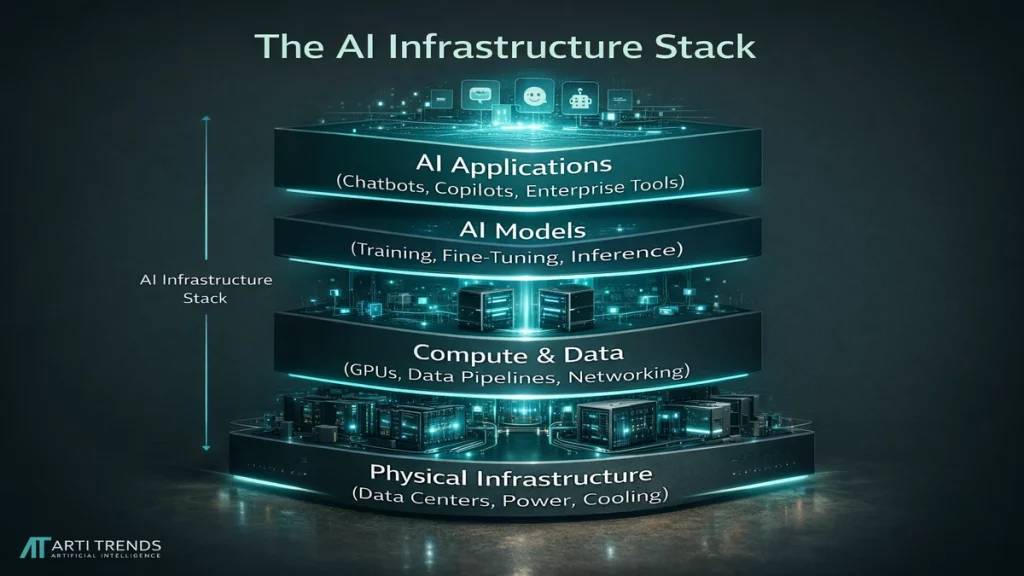

Training and operating advanced AI models now requires:

- massive GPU clusters

- high-bandwidth networking

- specialized data infrastructure

- continuous safety and evaluation systems

A $20B war chest allows xAI to internalize these layers instead of renting them. That gives the company more control over cost, performance, security, and long-term sustainability.

From Model Race to Infrastructure Race

The early phase of AI was about who could build the smartest model.

That phase is over.

The new competition is about:

- who can train at scale

- who can deploy reliably

- who can operate safely under regulation

This is the core of AI’s Infrastructure Dominance Phase — and xAI’s funding round is designed to compete in it.

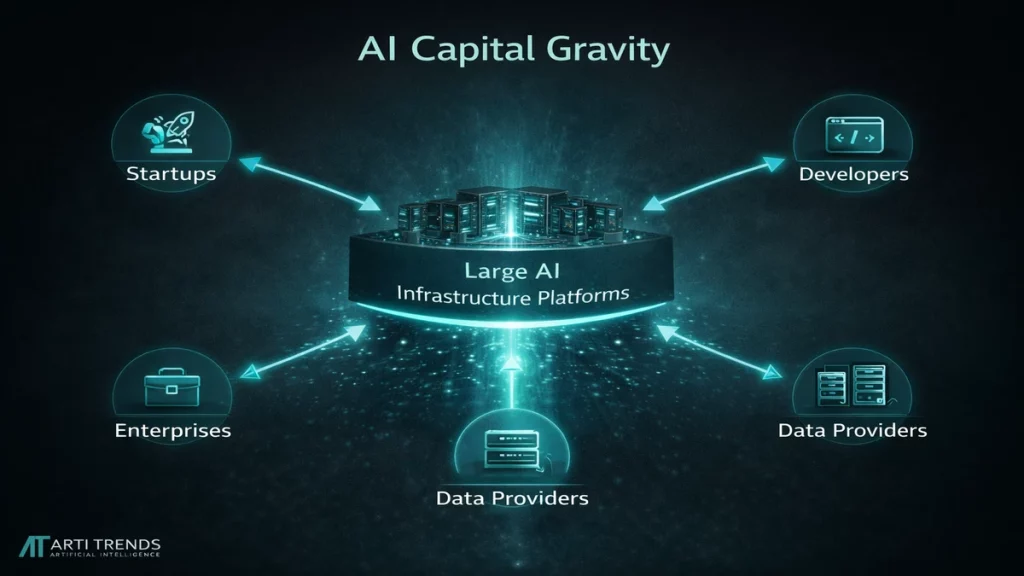

What $20B Means for Different AI Buyers

This funding wave affects every layer of the ecosystem.

For startups

Infrastructure giants raise the bar. Niche specialization and deep integration become the only viable paths.

For enterprises

Large providers become more stable — but also more concentrated. Vendor lock-in risk increases.

For developers

Platforms backed by massive infrastructure will deliver faster, cheaper, and more reliable AI services.

For regulators

Bigger players are easier to supervise — but harder to challenge.

Where xAI Is Likely to Spend the Money

While xAI has not published a detailed breakdown, the economics of modern AI make the priorities clear:

Compute and data centers

Owning the hardware stack lowers long-term costs and increases independence.

Model training and evaluation

Larger systems require continuous retraining, benchmarking, and safety checks.

Safety and governance

Regulatory pressure is rising — and only well-funded players can absorb compliance costs.

Product integration

AI must move beyond demos into dependable software platforms.

Why Investors Are Still Committing at This Scale

Despite rising costs and regulation, capital continues to flow into frontier AI.

That’s because AI is increasingly seen as:

- foundational digital infrastructure

- a long-term productivity engine

- a platform for entire new industries

xAI’s $20B round reflects belief not in short-term hype — but in the AI investment landscape becoming a core pillar of the global economy.

What This Signals Going Into 2026

The AI industry is becoming more like cloud computing or semiconductors:

- capital heavy

- infrastructure driven

- geopolitically sensitive

xAI’s funding round is not just about growth.

It marks the transition of AI into industrial-scale technology — a preview of the future of AI systems.

In the next phase of AI, winners will not just be the smartest.

They will be the ones who can build, run, and govern AI at scale.

Sources

This article is based on public statements from xAI and reporting by major financial and technology outlets, with analysis focused on funding dynamics, infrastructure economics, and the evolution of the AI industry.